bank owned life insurance tax treatment

The bank pays for the coverage and is the beneficiary after the insured persons death. The face amount of the policy if specified in the policy.

Key Man Life Insurance What Is It How Does It Work 2022

This of course is done within the context of a legitimate business reason.

. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. As shown in Figure 1 most community bank BOLI assets are considered simpler general account assets which are unsecured obligations of the insurance company. BOLI is a tax-efficient tool often used to offset the cost of an employee benefit program making it easier for banks to compete with other employers.

Understanding how bank-owned life insurance policies can impact mergers and acquisitions. Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and post-retirement employee benefits insurance on borrowers and. The new provision could have unintended consequences for bank mergers and.

Citizens or resident aliens for the entire tax year for which. IRS Taxation of Employer Owned Life Insurance. The bank purchases and owns an insurance policy on an executives life and is the beneficiary.

However at larger community banks as a whole the balances of BOLI assets in separate accounts or hybrid accounts grow. Individual Tax Insurance Services Wealth Management and Investment Advisory Services Trust Services. The separate accounts including varioussub-accounts typically consist of.

As the policys owner and beneficiary your bank harnesses unique benefits. In addition most BOLI policies are classified as Modified Endowment Contracts. A life insurance policy you can buy to insure the lives of your key employees.

While any insurance owned by a bank can be referred to as BOLI the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an opportunity for the bank to take advantage of tax deferred cash value growth. The new section limits the amount of tax-free treatment a person which can be any type of entity can receive from the proceeds on an. 1 the transfer for value rule and 2 business owned life insurance BOLI.

However an IRS rule codified in IRC Sec. However if they may be surrendered for their cash surrender values. Tax treatment is changed existing plans may be grandfathered.

5000 Life Insurance income account. 101 j 1 was added with the enactment of the Pension Protection Act of 2006 PL. IRC 101 j applies to employer.

Any gain above the premium that the bank paid would be taxed at the normal rate. 101 j subjects employer owned life insurance benefits to taxation unless they qualify for an exception and Notice and Consent requirements are satisfied. In general life insurance benefits received upon the death of an insured are tax-free.

This article reviews a recent Internal Revenue Service notice concerning the second exceptionbusiness owned life insurance and in particular the effect of Internal Revenue Code IRC Section 101j rules on. Upon the executives death tax-free death benefits are paid to the bank. Taxpayer maintains a BOLI Program in which it acquires life insurance policies from a variety of life insurance providers on a group of its officer-level employees.

3200 Conclusion The use of Life Insurance may be a key financial decision for your business. BOLI isnt the only type of employer-owned life insurance EOLI policy. Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy.

If federal income tax was withheld from the life insurance proceeds. In general proceeds from life insurance policies are tax free under the general exception rules in Sec. The tool is designed for taxpayers who were US.

If you are receiving the proceeds in installments whether there is a refund or period-certain guarantee. BOLI or bank-owned life insurance is just what it sounds like. Business Intelligence Solutions Host Analytics Microsoft Power BI.

The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a tax-free investment for banks sometimes but not always coupled with an employee benefit program. There are two major exceptions to income tax free life insurance death benefits. Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees.

The BOLI Policies are invested in the general accounts and separate accounts of the BOLI insurers. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. This general rule changed when Sec.

The type of BOLI held generally varies by the size of the bank. This tax-advantaged asset acts similarly to a bond allowing banks to offset the expenses needed for superior benefits andor informally fund executive benefits. What are the tax consequences of surrendering Bank Owned Life Insurance BOLI.

Cash surrender values grow tax-deferred providing the bank with monthly bookable income. Life Insurance premium expense account.

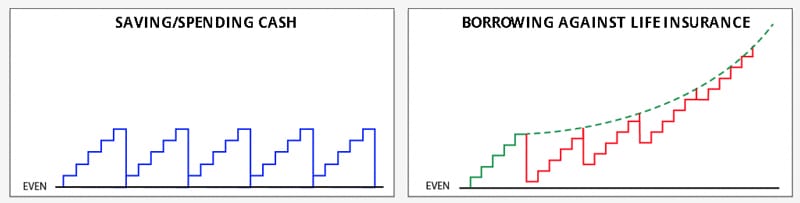

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Policy Loans Tax Rules And Risks

Boli Explained Paradigm Life Blog Post

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Understanding Taxes On Life Insurance Premiums

Boli Explained Paradigm Life Blog Post

Life Insurance Loans A Risky Way To Bank On Yourself

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

:max_bytes(150000):strip_icc()/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel

Boli Explained Paradigm Life Blog Post

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Common Mistakes In Life Insurance Arrangements

Tax Deductible Life Insurance Business Owners

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Policy Loans Tax Rules And Risks

Private Family Banking System With Whole Life Insurance Paradigm Life